Part 1: Research is what I’m doing when I don’t know what I’m doing.

Every article and half-baked LinkedIn post will tell you to do your research. Rarely do they tell you what kind of research, or what their steps include. Even when you focus solely on researching your audience, you can get swallowed by the information.

Where do you start?

What is quality research that will make your content relevant?

When should you stop and start applying the research?

Content and business objectives

The first step is to have a chat with your executive team (founder, CEO) and understand their view on marketing. It’s not about a specific strategy, tactic, or content format you want to get out of the conversation. Instead, you want to understand how they view your position, what they think success with content means, and what they would be disappointed by if the content didn’t even try to achieve.

They might get lost in their thoughts and start talking about launching a podcast or launching webinars, but this is not your current objective. Bring them back to the discussion of what they want to ultimately achieve with content. Is it helping sales in building pipelines? If so you know the ultimate goal - help sales build pipelines. Is the ultimate goal to increase organic traffic? Generate organic traffic. Is the ultimate goal getting sign-ups? Build a strategy around converting your audience into sign-ups.

Understand what business goals content should feed into and how your executive team thinks about content.

I would highly recommend listening to this podcast episode where Devin Reed discusses specific questions you need to ask your CEO.

Note: I learned a lot from Devin Reed’s content and I highly recommend subscribing to his newsletter. It’s a gold mine for professionals who want to up their content game.

Befriend your product, success, and sales teams

When you’re clear on the business objective, research:

Your audience

Your product

Startups often don’t document the insights of their audience and ICP and you’ll end up knowing just surphase level information. As long as the answer to your question “Who’s our audience” isn’t “Everyone” or “We don’t know yet” then it’s progress.

Product and success

Start by booking a meeting with your head of product, founder, whoever is in charge of developing the product, so you can learn how it works. It’s important to stay objective and gain an overview of the tool’s functionality, so you know what you will write about.

Then, you want to get a meeting with your customer success team, who will tell you how the best users use the product, provide examples of great use cases, and explain why customers love certain features, etc. At this point, you’ll start combining product research with audience research. If you’re lucky, there may already be emerging trends among the best-case users.

But if you’re a small startup then you might end up with not having too much data to work with. Maybe your current customer base consists of 10 accounts without anything in common. Yet getting those small nuggets of information will still be useful for you to know how those 10 clients use the product.

Become friends with your product and success teams. I would say a success team is more crucial because they need to give you the green light to start interviewing customers.

Sales team

You definitely want to befriend your sales team because their success in closing deals directly translates to your success. Without sales, you won’t feed into the business objective of generating revenue. Sales have the best insights into what persuades customers to buy, the types of objections they face, and the alternatives prospects consider. These insights may not always be well-documented.

It might be that most of the sales were made by founders without prior sales experience, and many customers were acquired in unconventional ways. They could be friends of the founders or former clients from previous ventures. If that's the case, you might have limited primary data, but don’t worry. We can supplement it with an indirect voice of customer research. More on this later.

If no one in the startup has documented how sales were closed, or the communication between the sales team and prospects who became customers, take the initiative yourself to get this done. You’ll appreciate it later when your CEO asks why you write what you write. You don’t want to be caught off guard and say something like 'the keyword has good volume' or 'our competitors talk about this too.' Instead, use as much data on your current customers as possible. Once documented, you can refer your CEO to the document.

Start initiating customer interviews and prepare for them. Your customer success team might be hesitant, but if you arrive with well-prepared questions that clearly outline the insights you seek and how you intend to use them, it will give them comfort in knowing that you know what you’re doing.

You might need to write a script showing how you would handle the conversation. If you already have experience with interviewing customers, your success team probably won’t ask this of you. If this will be your first time then this exercise will help you clear your mind and ease your nerves.

While you wait for customers to respond you will jump into indirect customer research.

Indirect voice of customer [IVOC]

Look through review sites on your product, competitor’s products, forums, online groups, subreddits, and comment sections. To make it easier for yourself, prepare a spreadsheet for the findings.

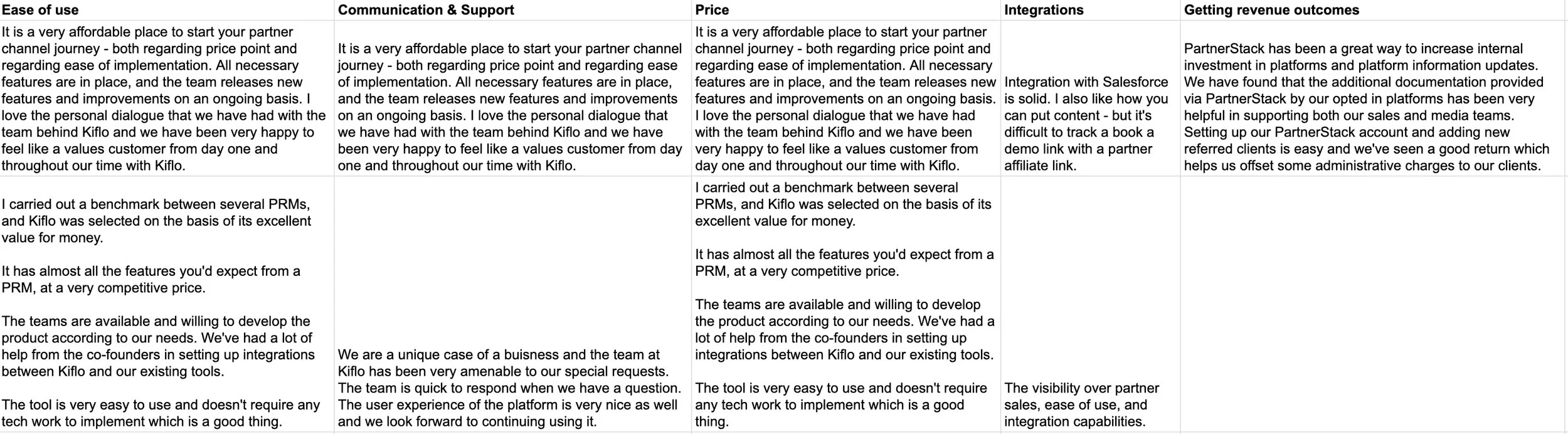

Let’s first start by going through review sites. The spreadsheet should have three tabs. One, general that includes all reviews. One for capturing all the positive trends customers mention about you and your competitors, and the other for documenting all the negative trends. (I’ll show you what it can look like below)

It’s easier when you start with the two dominant SaaS review sites G2 and Capterra - they have standardised templates for writing reviews.

Take your 5 biggest competitors on those platforms and see if they have any reviews. I like to start with 1 and 2-star reviews because customers are more explicit about what they dislike about the product.

To keep it clear the first tab will be the whole collection of reviews split by competitors. The next thing I like to document is the headline when I’m looking at G2 - this will help you identify trends and common terms your audience uses when describing desires and pains. The next column pros (what they like about the product), cons (what they dislike about the product), and the problem they solved.

So your initial tab can look like this:

IVOC - Capturing competitor reviews

Since your time is valuable, decide how much data you need to get started. For the top 5 competitors, gather at least 10 reviews each, totaling around 50 reviews. Include different ratings: 1 and 2-star, 3-star, and 4 and 5-star reviews. I focus more on negative and 3-star reviews to understand customer challenges deeply for differentiation, but it’s important to also consider positive reviews for balanced insights.

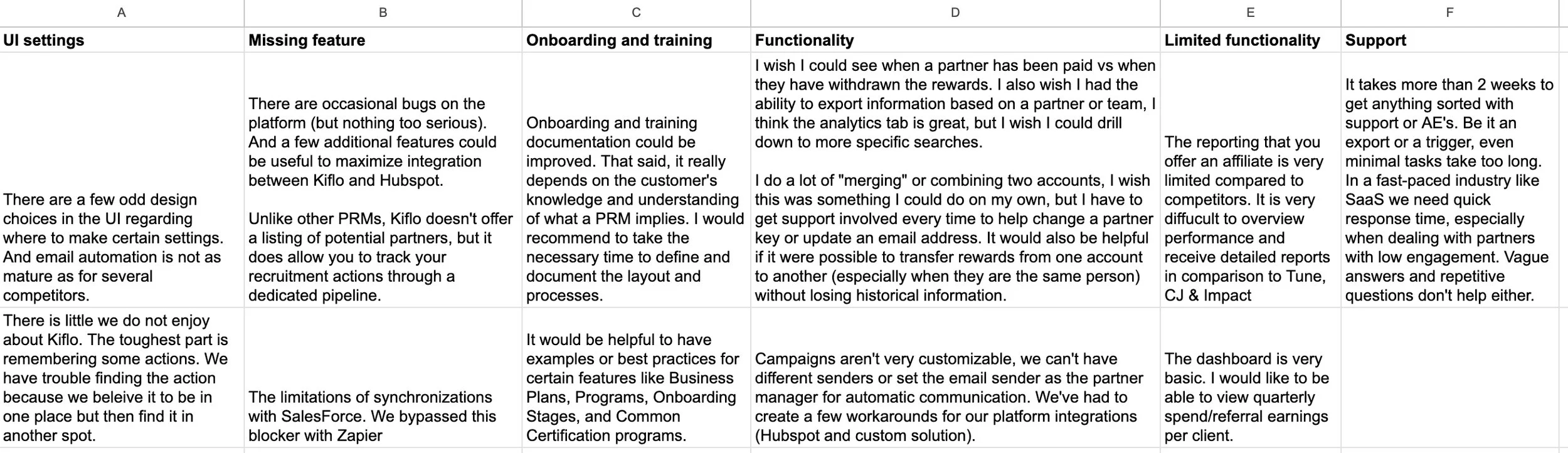

Next, create two tabs—one for pain points and the other for desires. Take time to read through the reviews and organize them by topic. For instance, if a review mentions dissatisfaction with customer service, create a column titled "Customer service" in the pain points tab. If a review praises the tool's ease of use, create a column titled "Easy to use" in the desires tab. This approach will help you categorize feedback fast.

IVOC - Positive trends

IVOC - Negative trends

Reviews can overlap because often people dislike multiple things. Use them multiple times in all the different contexts where they fit. The goal is to organise all those reviews into categories to see which category has the most reviews. That will be your starting point for addressing those problems in your content. Copy-paste exactly the way those people wrote their reviews to get raw insight into how they talk about their problems.

The last part of your initial research is to scout relevant forums, subreddits, social media groups, and comment sections under influential creators. When I was working for a startup that operated within affiliate marketing I browsed YouTube channels where creators educate their audience on specific topics within affiliate marketing. I skipped the channels that only promoted “get rich fast with affiliate marketing” because those are rarely reliable. And I didn’t have the luxury of time to dive deeper into their content to find out if they’re legit or not. Those that are legit usually create longer videos diving into a singular problem, even if you skip through the video you get the sense of how detailed they are in addressing problems and solutions. In the comment section, the audience usually describes why they found the video useful or mentions why the problem was so important to solve. Great place to gain more audience insights.

Don’t sleep on Reddit. Redditors are brutally honest (some are too honest), but it’s a great source of problem/solution discussions. Scout through Reddit manually or use GummySearch. I used GummySearch by grouping 5 subreddits that were active within affiliate marketing and I searched for competitor keywords first. My goal was to write a comparison page on our biggest competitor within affiliate marketing. I used the insight to assemble the landing page which proved to be one of the best converting pages.

The free plan is limited to 50 keyword searches. Once you’re out of your 50 keyword searches you won’t be able to revisit your findings, so make sure you copy-paste the relevant discussion into a spreadsheet.

When you look through those forums, social groups, etc. already engage with creators. Even if it’s just liking some posts, upvoting, if you’re brave enough leave a comment. This will help you get your face visible. I managed to increase a startup’s following just by engaging with relevant creators who then were curious enough and open to further discussions.