Part 2: Creating content with purpose

This is not set in stone structure, nor is it a template where you fill in the blanks. Think about it as a bookshelf you want to fill with your own books. Not mine. Not the LinkedIn guru who tells you to steal their template “This is how I built 7 figure business and you can too” only to later read some basic advice.

Instead, you’ll get a perspective on how to think about creating a content plan, so even if your CEO isn’t a marketer they will understand what you’re doing, how you plan to accomplish it, and how it should all tie into achieving a business objective.

Format your planning

Use the research you’ve done, open a new spreadsheet, and create four tabs. One is for mapping out your customer journey, the second is for key problem areas your audience cares about, the third is defining what you want to create and where it should be published, and the fourth one is about the way you choose to observe the market’s reaction.

Note: The first time I was introduced to this four-step process was in Devin Reed’s newsletter about his content flywheel. I was heavily inspired by it. So, as any good marketer, I decided to steal it and make it my own. Most of what I know I learned from him and I tried to readapt his insights and frameworks into my circumstances. I’ll mention Devin as the OG source a few times so you might as well check out his content.

Back to the show.

Planning

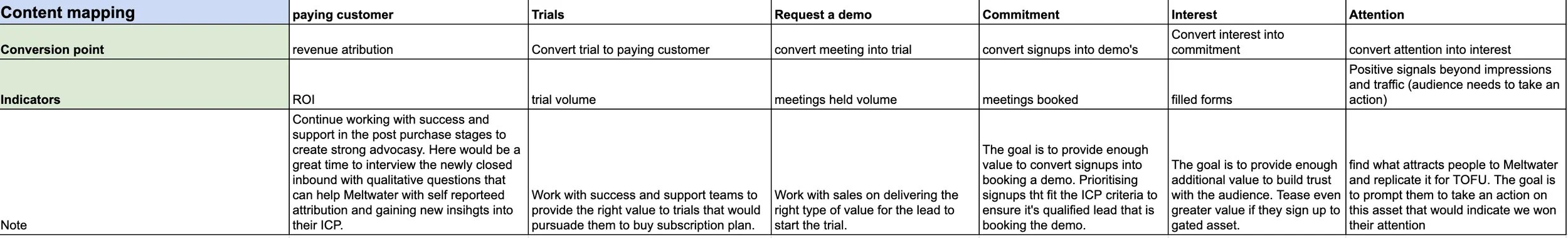

The first tab - mapping your content across the buyer’s journey.

I’m not going to describe the buyer's journey. It’s a widely known model and by this point, you can ask chat GPT to get a reasonably good answer on how it works.

I start with the end result at the bottom of the funnel and make my way backwards to the top.

Let’s say your ultimate goal is to increase the revenue. You can increase the revenue even post-purchase stage, but here we will focus on creating a content plan to acquire new customers. That should be in your cell A1 of your spreadsheet.

Cell A2 is the indicator you’ll look at to decide whether your content is successful or needs adjustments.

For example, under revenue, your indicator might be paying customers. Then reverse engineer to the TOFU content.

The one step before paying customers might be trials

A step before that might be booking a meeting

The one before booking a meeting might be a form submission

Before that is a step I like to call commitment, that’s where your audience needs to show more interest in your content → subscribing to your newsletter, signing up for a webinar, or downloading gated content

Keep in mind that just because they showed commitment doesn’t mean they’re ready to talk to your sales yet.

Before they can show commitment, you want to get their attention. The way I defined it was not with traffic because I experienced a situation where the traffic coming to the website was not relevant. So, I chose a metric that would indicate they wanted to explore more from their first touchpoint. That could’ve been referral traffic from an article I published on a forum, redirected traffic coming from social media channels, or a CTR for an inbound link.

Define all those stages so your managers, founders, and other important stakeholders understand what you mean by all those terms. I remember banging my head on a table because I knew what I meant by winning attention, but I didn’t know how to articulate it for my managers. It turned out my idea wasn’t fully fleshed out yet. So, I brainstormed (with myself) until I fully grasped what I meant.

Then you want to set up benchmarks. If you’re early and don’t have enough data to set benchmarks based on historical data, you can use general benchmarks. Set them up, and even if you don’t hit them, you will still have an idea about your performance. If you don’t have benchmarks that can signal what’s good performance and what’s not, you’ll be you’ll be tapping in darkness.

I used these benchmarks for an early-stage SaaS startup that didn’t have marketing data to start with.

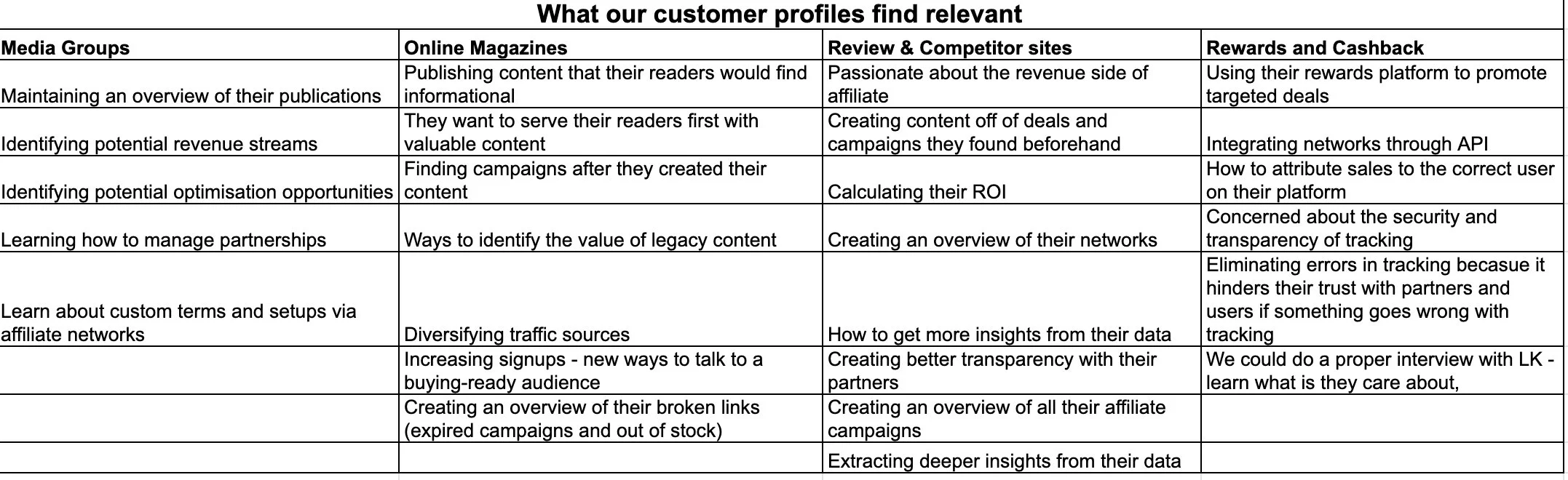

SMEs knowledge and audience interests

Your second part is all about using the insights of your subject matter experts (SMEs) and matching them with your audience's interests. Imagine for a second that your audience consists of complex human beings with many different interests. Your SMEs can likely talk about many different topics within your startup’s and your product’s capabilities… But are all of them interesting to your audience? Does your audience find all of those topics relevant? I’ll let you be the judge of that.

Asking yourself what’s relevant to your audience isn’t a one-time thing. Whenever your startup shifts directions, something important happens in your industry, or a new tech emerges that changes how people consume content, you should come back to your audience and ask yourself again, “What content do they find relevant?”

Cross-referenced audience interests and SMEs knowledge

What I did here is to take ICP descriptions of different segments, and under each segment, I wrote relevant topics discovered throughout my research.

Keep this simple and clean for your own and your stakeholders’ sakes.

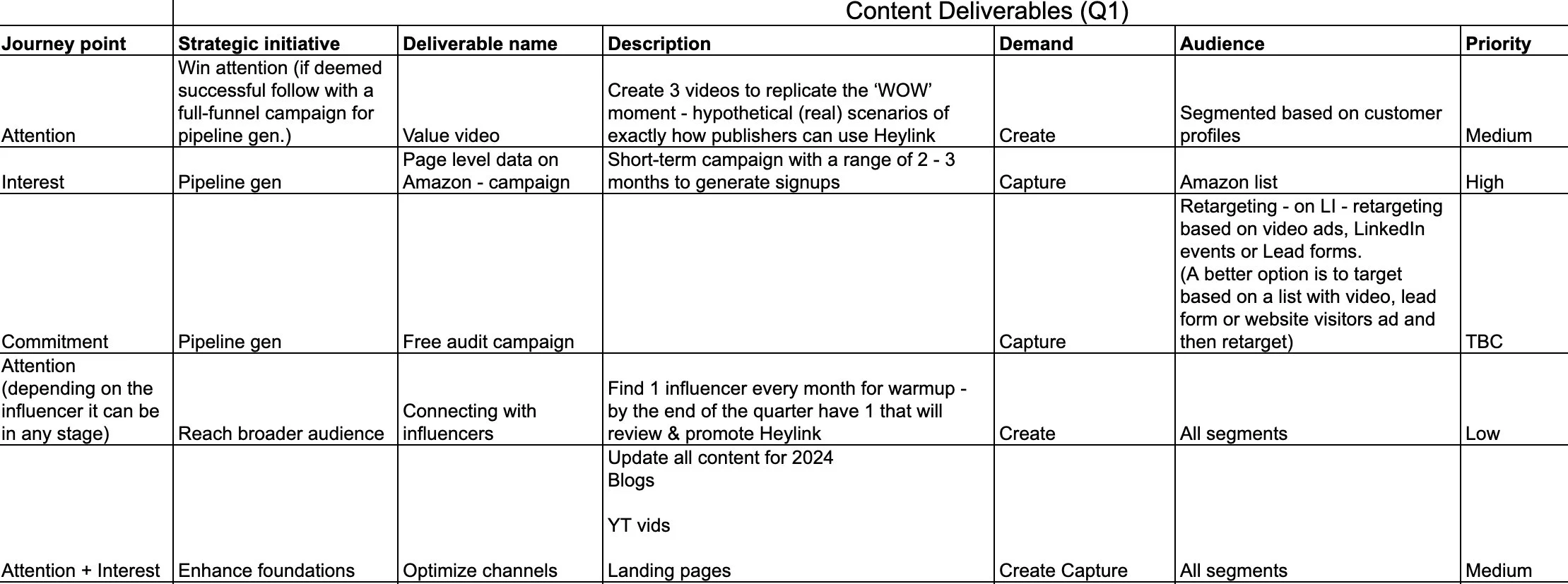

Production and distribution

We’re getting to the fun part - production and distribution. Still from the strategic perspective, I like to design this section that includes several parts, but it boils down to the specific initiatives and their purpose.

Note: This is heavily inspired by Devin Reed's content deliverables.

Here’s an example of how I used it while working for a SaaS startup.

The categories I included are: the journey stage the initiative is intended for, the strategic initiative, the name of the initiative, a short description, the channel where it’s going to be published, and the purpose.

You can always review the priorities and shift if there’s a reason. Startups shift a lot, and the hardest part is that they can change your ICP - they start very broad and it takes several rounds of experiments to narrow down the focus to make your messaging more effective.

But you can’t optimise if something doesn’t exist. You can’t optimise a messaging strategy, or content strategy if there’s no strategy to begin with.

If your CEO asks you “why are we doing those initiatives”, you’ll quickly try to think of an answer and you say “brand awareness”, it’s going to be a rough explanation without a plan. I’ve been in that position. Be prepared for a follow-up question “What indicators will you look at to see if we’re getting brand awareness?” and “What kind of impact on MRR can we see from brand awareness within a few months?” Writing a plan like this will help you explain it much better.

When presenting the whole plan to my CEO I skipped a few things to make it faster to go through. My CEO didn’t need to read content descriptions, if the content is going to be repurposed, and how. What he needed to know is whether the initiatives I wanted to launch had a purpose and whether that purpose aligned with the main business objective - generating revenue.

Observing your audience’s reaction to your content

How you observe your audience’s reaction needs an intent.

What would you consider a positive signal from the market for your content? Getting enough attention, ideally from your target ICP. You’d prefer your target ICP takes an action - immediately calling and saying:

But you see, the reaction from your market can be vast and a lot of times even unmeasurable. For example, you can be posting for weeks on LinkedIn, get a couple of likes, comments here and there, your CEO might even reshare it, and this can be going on for months. And you might be thinking what you’re posting doesn’t work. Hold your horses.

There could be silent observers, lurking accounts reading your content. When they're ready, and your sales team reaches out to them, they might be more willing to engage. This type of impact is hard to measure because you may not know if your content sparked curiosity in them.

Choose the signals and metrics you want to look at in relation to others. For example, you might receive many likes, which seems successful (and it is), but are those likes mainly from your colleagues and their families, or from your target audience?

The metrics you set in your Plan tab should guide your observation methods.

Metrics don’t live their lives on their own. You need to observe them in relation to something else. For example, imagine a situation where you frequently post on LinkedIn. You hit around the same number of impressions with all your posts. Then you start noticing that the impressions decreased for several posts.

What does a lower trend of impressions tell you? Besides that fewer people see your posts…

Not much? You might start thinking that your posts suck and you need to change something immediately. But impressions on their own don’t tell you what works and what doesn’t. You need to choose in what relation you look at impressions. Social media managers usually take a metric like impressions and look at them in relation to a rate metric (engagement rate, conversion rate, CTR…)

Note: If you’re running ads then you should definitely look at the frequency as well. There are 6 essential metrics you always want to look at in relation to the results of your paid campaigns. You can read about them here.

Now you have a clear picture of what content you need to produce and how is it going to help your startup achieve business goals. Keep in mind that as your startup evolves, you'll need to revisit and adjust things based on new insights. It's possible you'll discover that your initial ICP isn't quite right. You might need to narrow it down or change it altogether as you acquire more customers and understand their needs better. Or maybe you’ll find out the best channel to reach your audience isn’t LinkedIn like you thought but it might turn out to be YouTube.

The most important part is to have a strategy that isn’t reliant on specific tactics or channels. Some experts might say content strategy equals SEO or a mix of SEO and social media. No. Those are channels.

The only thing your content strategy should rely on are the insights about your audience.